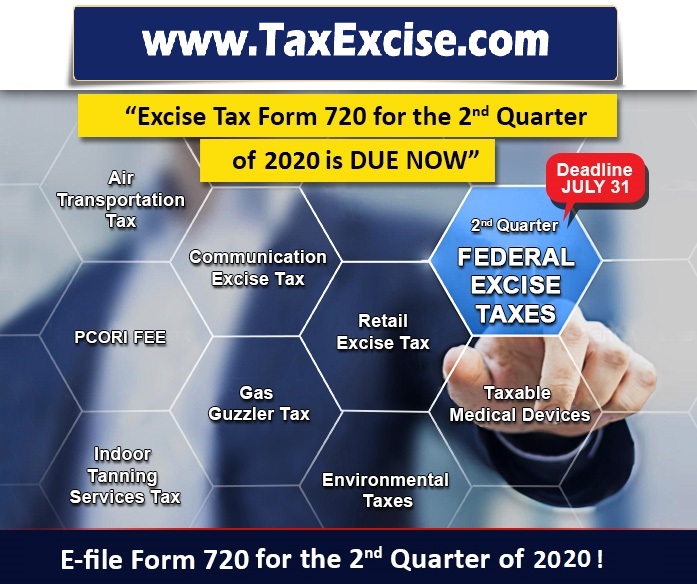

As per the IRS Notice 2020-48, There are certain relief for excise taxpayers report and pay the excise taxes on sport fishing equipment, bows and arrows etc. filing deadline has been extended further. The Form 720 due on July 31, 2020, covers the second calendar quarter (April, May, June) of the year 2020. Refer to the notice here.

Any person (as defined in section 7701(a)(1) of the Code) with a federal sporting goods excise tax payment due and the requirement to file a return under the sport fishing and archery equipment on July 31, 2020, is determined to be affected by the COVID-19 emergency for purposes the July 31, 2020, due date for filing Form 720 for the sport fishing and archery equipment numbers and making corresponding federal sporting goods excise tax payments is automatically postponed to October 31, 2020. This relief is automatic. Affected Taxpayers do not have to call the IRS, file any extension forms, or send letters or other documents to receive this relief. An Affected Taxpayer may file a Form 720 for excise taxes and pay the corresponding excise taxes on sport fishing and archery equipment by the normal due date (July 31, 2020) if the Affected Taxpayer so chooses. An Affected Taxpayer who takes advantage of this postponement should file only one Form 720 for the sport fishing and archery equipment numbers by the postponed deadline of October 31, 2020, on an IRS Number line if the taxpayer has excise tax liability for the tax corresponding to that Number and this Notice postpones the payment of that tax (in other words, avoid duplicate filings).

Continue reading Relief for Taxpayers Affected by Ongoing Coronavirus Disease Pandemic, Related to Sport Fishing Equipment and Bows and Arrows Excise Tax Filing and Payment Deadlines