ThinkTrade Inc. is a federal tax preparation software development company for small businesses, accountants and individuals. The company is headquartered in Brentwood, Tennessee. An IRS authorized electronic filing service provider since 2007. A BBB accredited company with A+ rating since 2010.

ThinkTrade Inc. Owns and Operates TaxExcise.com and Tax2290.com, the most preferred Truck Tax eFile website, most experienced and the 1st IRS authorized eFile provider.

The online web tax product www.TaxExcise.com, is the first of its kind tax preparation application for truckers, owner operators and trucking business owners across America to report and pay Federal Vehicle Use Tax Form 2290 also referred as Heavy Highway Vehicle Use Tax (HVUT) with the IRS. The Quarterly Federal Excise Tax returns can be prepared and reported using Form 720 through www.TaxExcise.com, this is the only web product to report and pay the Quarterly Federal Excise Tax returns online. The Excise Tax refund claims can be made using Form 8849 from our web products.

Federal Excise Tax consists of 3 major Tax Forms such us:

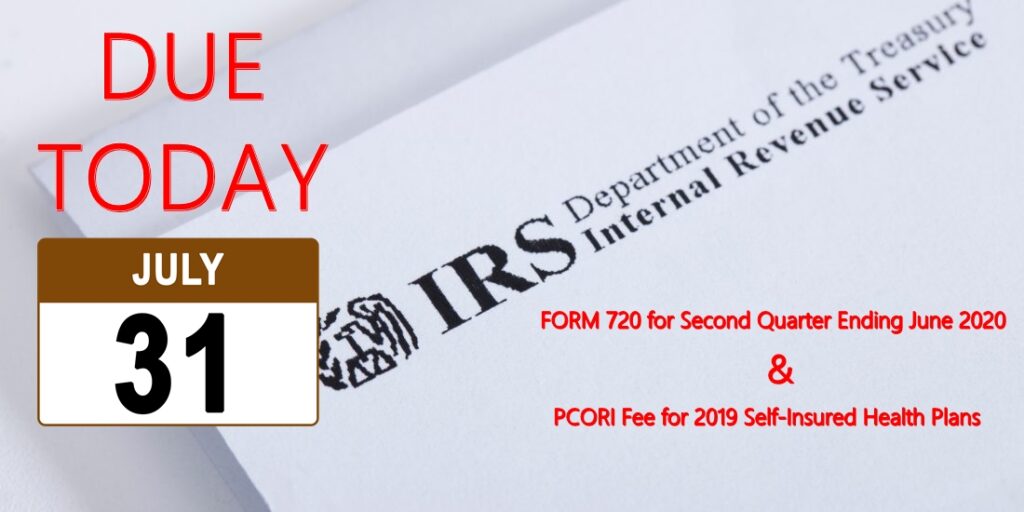

Form 720 — Quarterly Federal Excise Tax Return | www.Tax720.com

Form 2290 — Federal Vehicle Use Tax Return | www.Tax2290.com

Form 8849 — Claim for Refund of Excise Taxes | www.Tax8849.com

Continue reading ThinkTrade Inc a Tennessee Based Tax Software Development Company